Student banking

Student Product Bundle

Role

Product designer

Platform

Desktop and mobile web

Year

2024

Problem

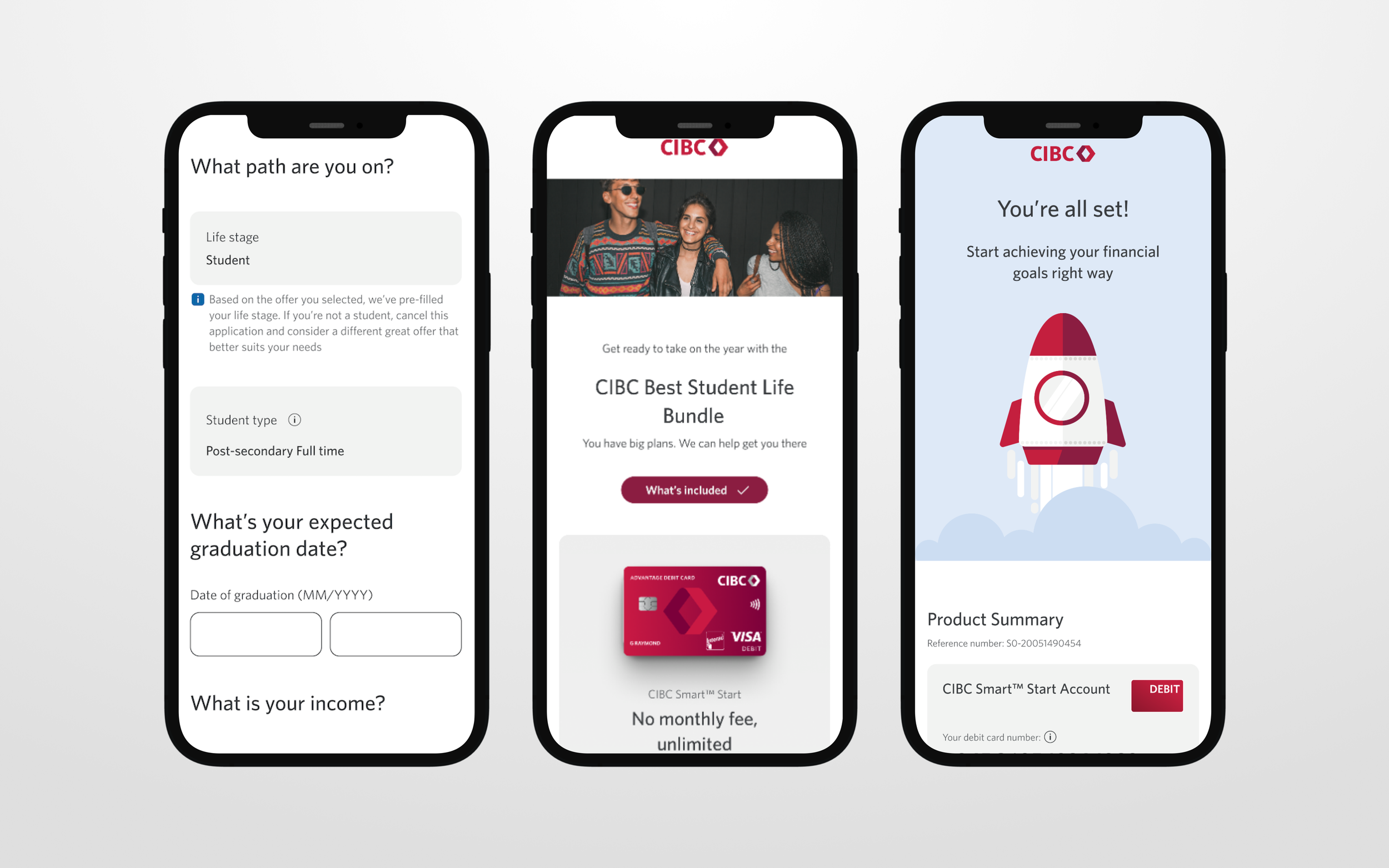

Applying for multiple products can significantly increase the complexity of the banking application process, especially for international students and those who are new to banking at CIBC. Many students often operate with limited budgets and prefer to manage their banking without worrying about incurring large monthly fees, paying for most individual transactions, or facing high interest rates on credit cards. Student bundles are designed to allow young people to begin their financial journey in a more organized and prepared manner by providing a comprehensive toolkit of products that support their everyday financial needs and activities. It became clear that there needed to be a straightforward way for students to easily understand the importance of each product and to make this process more convenient through a self-service online platform.

At the start of the project, understanding the flow and new pages impacted was important. Thoughtful design not only guides users smoothly through their application but also enhances engagement with prospective customers.

User testing

During user testing, many of the 7 participants struggled to fully understand several of the product’s offerings and key requirements. There was notable confusion surrounding the age of majority criteria, associated fees, welcome offers, and other important details. This crucial initial feedback played a significant role in shaping the overall direction of the project because students would ultimately apply for the product based on their interpretation of all these factors. It became clear that the imagery, language, and highlighted features needed to be carefully crafted to effectively attract and engage them.

Solution

The aim became to create a comprehensive bundle consisting of three essential products. The target audience comprised of students who would require these financial services: a deposit account, a savings account, and a credit credit. These products were designed to support their immediate needs while providing opportunities for them to develop into valuable, long-term banking customers over time.